Thru-Hiking on a Budget: How to Save & Cut Costs Before You Go

Preparing financially for a thru-hike is just as critical as physical training and gear selection. While researching ultralight setups and perfecting your trail legs are important, having a solid financial plan ensures you won’t run out of money halfway through your hike. Long-distance trails—especially iconic ones like the Appalachian Trail or Pacific Crest Trail—can cost thousands of dollars when you account for gear, resupply stops, town stays, transportation, and unexpected expenses. Without a financial cushion, you risk cutting your adventure short due to a drained bank account rather than physical exhaustion.

No matter where you fall on the spending spectrum, the key is planning ahead. Unexpected expenses—like replacing broken gear, medical needs, or extra transportation costs—can easily derail an unprepared hiker. Having a financial buffer ensures that when challenges arise, you can handle them without jeopardizing your entire trip.

Ultimately, thru-hiking is as much a mental and financial challenge as it is a physical one. The more prepared you are financially, the less you’ll have to stress about money and the more you can focus on the trail ahead.

The price of a thru-hike generally falls between $1,000 and $2,000 per month, not including your regular living expenses back home—things like rent, a mortgage, insurance, or phone bills. It also does not account for all the gear you might need before setting out. This range isn’t a hard rule; some hikers manage to scrape by on less, while others spend significantly more.

To put it into perspective:

- $1,000/month – The budget-conscious, ramen noodle approach: bare-bones spending, minimal town visits, and a frugal resupply strategy.

- $1,500/month – The mid-range Knorr rice sides budget: a balance between saving and splurging, with some comforts along the way.

- $2,000/month – The Mountain House (or premium dehydrated meals) budget: allowing for more indulgences, frequent town meals, extra gear upgrades, and a generally more relaxed experience.

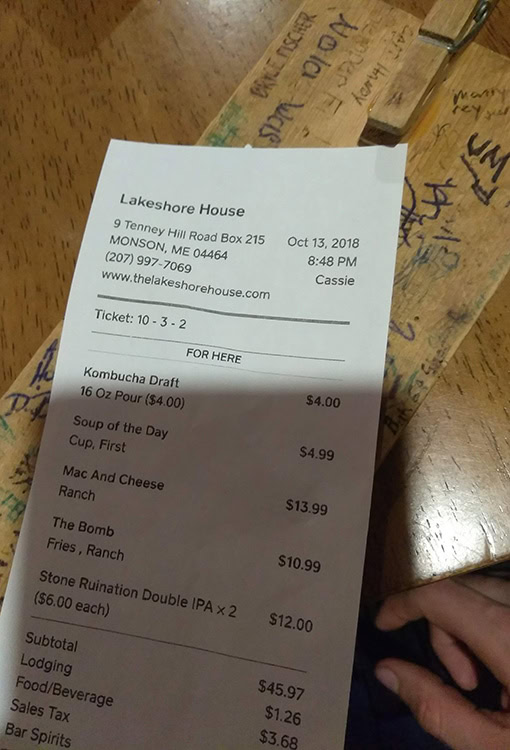

At the lower end of the budget spectrum, you’ll need to be strategic about resupply points, limit your time in town, and be mindful of where every dollar goes. Every hotel night, restaurant meal, and craft beer adds up quickly. That said, hiking frugally doesn’t mean sacrificing the experience—it just means being resourceful. Many budget-conscious hikers rely on hiker boxes, split motel costs with trail friends, and opt for affordable resupply options rather than frequenting high-cost grocery stores near trail towns.

On the other hand, if you have more financial flexibility, you can allow yourself extra comforts—higher-quality trail meals, more rest days (zeroes), regular town food, and even occasional gear replacements. A higher budget generally means less financial stress and more room for spontaneous experiences, whether that’s taking a side trip to a national park, staying in a cozy hostel, or simply enjoying a well-earned feast without worrying about the tab.

WHAT TRAIL ARE YOU HIKING?

Entertaining the idea of a thru-hike and actually committing to making it happen are two very different things. While it may seem obvious, you don’t have to take on one of the “Big Three” trails—the Appalachian Trail, Pacific Crest Trail, or Continental Divide Trail. Each of these demands a significant time investment, typically ranging from four to six months or more.

It’s easy to get caught up in the allure of the major trails, but there are plenty of shorter alternatives, like the John Muir Trail, the Long Trail, or the Colorado Trail, to name a few. These span a few hundred miles rather than thousands, making them more accessible for those who don’t have the time for a full triple crown hike. Instead, you might consider the “triple tiara,” which requires only a month to a month and a half of planning, funding, and hiking.

A shorter trail means a smaller budget, but costs still depend on factors like time spent hiking, town visits, and overall trail duration. The more time you linger in town, the more expenses pile up. What starts as a simple meal with trail friends can quickly turn into a feast—burgers, fries, ice cream, appetizers, and most likely beer!. Hiker hunger is real, and you might underestimate just how much you’ll want to eat. Being mindful of town spending can help keep your budget on track.

Developing a financial plan can help ensure you’re putting money aside rather than spending unnecessarily. If you’re not already tracking your expenses, there are plenty of online tools and templates available to break down your monthly costs. While budgeting might seem straightforward, its effectiveness depends entirely on how well you stick to it.

CUTTING UNNECESSARY SPENDING

Let’s consider a one-year savings goal by identifying areas where small cuts can add up. We’ll focus on discretionary spending—things that aren’t essential but still impact your wallet over time.

- A single Starbucks visit per week at $5 adds up to $260 per year.

- A pack of cigarettes in the US costs around $8.10. Over 52 weeks, that’s $421.20 annually.

- A six-pack of beer each week, priced between $9 and $15, amounts to $468 – $780 per year.

- Skipping one restaurant meal per week, averaging $15–$20, results in $780 – $1,040 in savings annually.

Just by cutting back on these four expenses, you could save anywhere from $1,929 to $2,501 in a year. Of course, these are just examples—if none of these apply to you, consider other small purchases that add up over time. The key is identifying non-essential spending and making intentional choices to set aside more for your goals.

BEERS AND TOWN FOOD COSTS A LOT!

A FRESH APPALACHIAN TRAIL RESUPPLY

AUDITING YOUR SERVICES AND MONTHLY FEES

Services like Netflix, Hulu, Spotify, Zoom, Amazon Prime, etc. all sneakily add up over the year, especially if you don’t even remember the subscription being active.

Let’s say you’ve got a basic entertainment services package of Netflix, Spotify, and Amazon Prime. Let’s take a look at how these stack up as expenditures in 2025.

Netflix – A $17.99 per month subscription(without ads) turns into about $215.88 annually

Spotify – A $11.99 per month subscription turns into $143.88 annually

Amazon Prime – A year subscription is currently $139

Dropping these three services for a year would net you a little over $498 which might not seem like much in regard to the amount of entertainment you’re forfeiting, but that’s about one to two weeks’ worth of trail expenses.

Combine that with our discretionary spending cuts and by cutting out just 6 items we can save $2,427 to $3,000 dollars. That’s more than enough for time on the Colorado Trail!

REDUCING EXPENDITURES LEADING UP TO TRAIL AND COVERAGES WHILE ON TRAIL

- Car insurance can be lowered due to coverage type. If you’re just going to have your car sitting idle, why pay full coverage on it? Try reaching out to your insurance provider and see if you can lower your coverages and payments. You can reduce your coverage and save some money while unemployed.

- Phone coverage can also be reduced. Since you will be out of a service area fairly often, lowering your phone coverages and bills might be a good idea. Switching to a cheaper plan could cut your monthly bill in half.

- Can you rent out your house or condo if you own them to help cover those expenses while out on trail? Instead of the domicile sitting vacant and costing you money at the same time, consider renting it out.

- Can you get a cheaper rate for your current utilities or internet bills? Competitive shopping to drive down your overall monthly expenses might be worth the time it takes to figure this stuff out.

HOW TO PLAN WHILE ON TRAIL

Pre-plan for town days and services – Make sure you are honest with the number of rest days you’ll end up needing, and remember for every zero day, you typically need two nights in a room–one for the night you get into town and the second for the zero itself. Think of things like laundry, lodging, showering,resupply, etc. You don’t have to have absolutely everything planned out, but having a general understanding of your pace and food needs will help a great deal.

Spend less time in town – Town stops are the major bank breaker for thru-hikers. Lodging, food, gear replacement, shuttle costs, picking up a package, resupplying, food with friends–it adds up quick. Making sure you are comfortable in your efforts on trail to avoid needing zeros or double zeros is an easy way to pace your spending.

Get your food rations dialed in – Many are guilty of buying more than they need and carrying the unnecessary weight, but those leftover packs of ramen or whatever you bought are also unnecessary spending. Knowing exactly how much you need will help cut down on this. Counting calories is an easy way to do this.

Split accommodations with others/work for stay – Splitting hotel rooms is the easiest way to save some money when it comes to lodging and seems pretty obvious. Be sure you’re not taking the opportunity overboard and always respect lodging rules for the amount of guests. Always remember you’re a steward for thru-hikers everywhere and we don’t want to wear out our welcome. Some hostels along the major trails allow a work for stay trade, while this is a great option for most, many a time we’ve seen thru-hiker hopefuls get caught in the vortex of town and partying every night at the hostel.

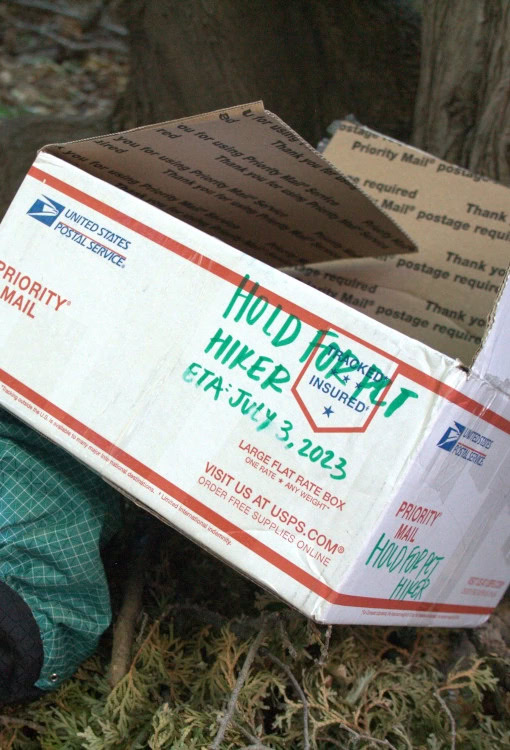

MAILING RESUPPLY MIGHT NOT SAVE MONEY

Consider your resupply strategy; Are you going to send yourself boxes or be resupplying as you go?

- Shipping boxes might not really save you any money – you not only are paying for the in-store item, but you also have to pay for shipping on top of that, as well as the possibility of having to pay a hold charge wherever you plan on picking it up. That resupply you bought back home with a great savings budget in mind, after all is said and done, could cost an extra $30 when shipping and picking up from a hostel or general store are concerned. Be sure to ship to a post office to avoid holding fees if this is a strategy you’ve already committed to.

- Resupplying in town is a good option for more convenience and taste bud change. But some towns have higher pricing and less desirable options than others. It’s always an unfortunate experience having to buy ten wing-dingys from a gas station resupply only to find that by the third, you’re sick of them and can’t stand to stomach another, much less having to pay per-unit pricing on anything in there. Towns also tend to have hiker boxes where other hikers ditch extra food but don’t rely on them as that could put you in a bad situation should it not pan out the way you thought it would.

RE-EMERGENCE INTO LIFE

Have money set aside for when you are done with trail so that you have some run-way room to get reestablished. This might not be as much of a concern for shorter trips, but if you’re planning on returning from an extended time away to move cities, change jobs, or whatever you left before, you definitely should. You’re absolutely going to need some fallback money. I’d recommend at least two to three months of living expenses as a re-settlement fund(5-6k). Remember to consider any deposits you might need for a new place to live as well as the amount of time it takes to secure a new job, and acquire a receipt of the first payment from said job

FINAL THOUGHTS

Financially preparing for a thru-hike means setting realistic goals, planning carefully, and sticking to a budget. The financial side of hiking is as important as physical and logistical preparation, and it can greatly impact your overall experience on the trail. By saving strategically, minimizing debts, and keeping your spending in check, you’ll be ready to focus on the journey ahead and fully enjoy the freedom of the trail.

0 Comments